How To Calculate Commission In Real Estate: 4 Easy Steps To Get It Right

Real estate agents typically earn about 6% sales commission, which can be substantial depending on the property’s selling price. The average home price in the U.S. is $434,050, meaning a 6% commission would be $26,043.

Your agents must receive the correct commission fee from your brokerage, especially since research indicates that 44% of employees would consider leaving a company due to incorrect payment.

Haphazard commission calculations and reporting often result from underestimating the process or not accurately calculating splits, fees, royalties, and taxes.

Understanding how to calculate real estate commissions accurately is crucial for keeping your agents happy and motivated.

In this article, we’ll cover some best practices for calculating broker and real estate agent commissions that will help keep your business growing and your team happy.

| 💰 Key Terms You Need to Know To help you understand this article better, here are some of the key terms we will be using: Selling price: This is the final amount a property sells for, which could differ from the listing price. Commission percentage: This is the percentage of the selling price that goes to the buyer’s agent and the seller’s agent, typically a 50/50 split. Agent commission rate: This is the percentage of the real estate commission that your agents receive. Agent fees: These are fees that real estate agents may be required to pay your brokerage to cover various costs. Gross margin: The difference between the revenue you’ve earned from commission-based transactions and the direct costs associated with generating that revenue. |

What Is a Real Estate Agent Commission Model?

Many real estate agents and brokers are independent contractors who earn a living based only on the commission they generate from a final sale price.

For your real estate agents, the prospect of earning higher commissions is a powerful incentive to encourage them to deliver their best work. The commission model helps real estate agents to:

- Cultivate a pipeline of prospective buyers and sellers.

- Determine how to position real estate to increase value.

- Determine other actions to improve their earnings and increase your brokerage’s gross revenue.

A commission-based compensation plan motivates entrepreneurial-minded real estate agents to put their all into each deal, knowing their hard work will directly result in higher earnings.

However, a commission percentage model can be challenging to manage because you have to determine how to calculate commission based on the transaction value of every sale instead of paying your staff a fixed salary for each commission period.

You can think of commission as a piece of the selling price pie. This portion must be carved into additional smaller slices that reflect the fees, taxes, credits, and other amounts owed to various stakeholders.

How to Calculate Commission in 4 Easy Steps

Now that you know what a commission model is, you can follow the steps below to calculate it:

1. Calculate the total sales commission

The first step in calculating the final net payables for each real estate agent is to determine the total commission to be shared.

Unless your brokerage represents both the buyer and seller, the gross commission is split between brokerages. Typically, commission is split 50/50 between the buyer agents and the seller agents.

Often, if the commission is 6% of the sale, the buying and selling agents would each get 3%, but because commissions are negotiable, this rate may vary.

For example, if your brokerage represents the buyer and seller, the total commission earned is often lower, as one brokerage will receive the full fee. A seller’s agent may also negotiate lower commissions in other situations.

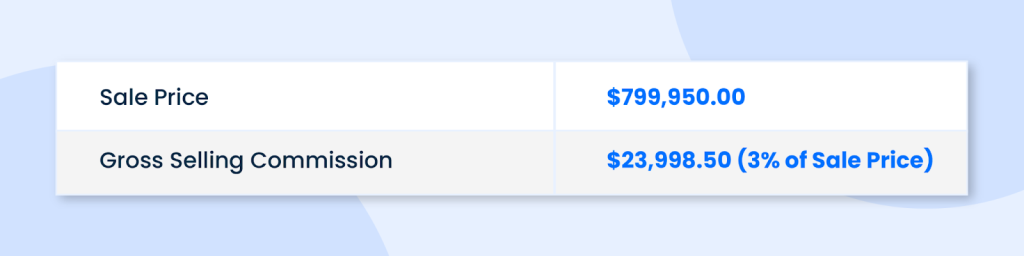

Here’s an example of a 3% real estate commission earned on a sale price of $799,950:

2. Account for off-the-top fees

There may be other stakeholders with a claim to some of the monies earned as part of the commission and listing agreement.

For example, if your brokerage is part of a larger organization, you might need to pay franchise or royalty fees, and you may also have to cover referral fees to another brokerage when necessary.

To accurately calculate everyone’s share, it’s necessary to account for these fees that are added to the total commission, as they will affect the remaining share.

For example, on our $23,998.50 gross commission, we need to account for a 7% franchise fee. The amount of commission left to be split between the brokerage and the listing agent would be $22,318.60:

3. Calculate the commission split with your real estate agent

Once you have identified the commission plan and the total gross commission for a transaction, you can easily calculate the gross commission for the real estate agent and your brokerage.

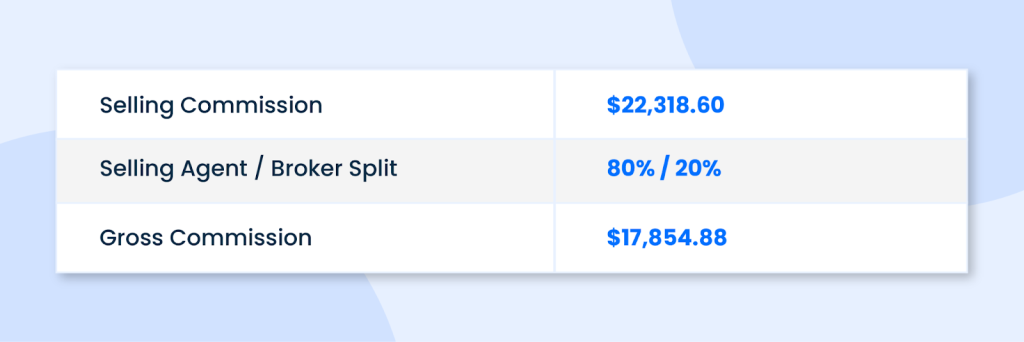

For example, on our distributable commission of $22,318.60 and an 80/20 commission split, the brokerage will keep $4,463.27, and the agent will earn $17,854.88:

4. Don’t forget about other fees

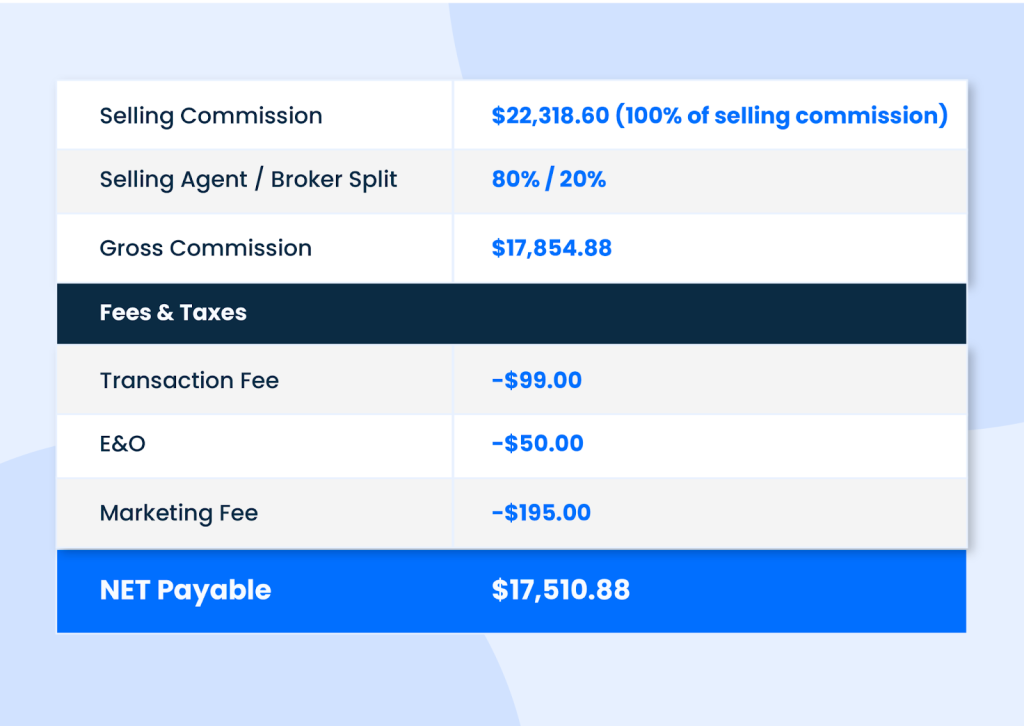

The final step is to account for other fees that the brokerage should charge the agent and collect. These include errors and omissions (E&O) insurance, transaction management fees, or marketing fees.

Sometimes, the agent may charge fees to the client and pay them to other entities, such as professional photographers or independent transaction coordinators. You may also need to account for funds collected from the buyer or seller and paid to the brokerage or agent.

Additionally, you should be wary of any client fees, as handling them incorrectly can cause calculation and reporting errors.

For example, your agent may owe a transaction fee of $99, an E&O fee of $50, and a marketing fee of $195, all paid to your brokerage:

Defining Your Commission Plans

Just like traditional employers negotiate salaries before finalizing an employment agreement with a new hire, you’ll need to establish and agree on a commission structure and split with any new real estate agent you recruit.

The commission split refers to how you divide the commission earned by your brokerage on a real estate transaction with your agents.

This means you will have to understand different commission tiers and lead sources, and consider which situations you would offer your agents a higher or lower cut.

As mentioned earlier, it’s also essential to consider the other fees included, such as E&O or transaction management fees. This split ratio would apply to any sales agents working for the real estate broker.

The share of the commission reflects both the value your firm provides to your real estate agent, including office space, supplies, and transaction support, as well as the agent’s contribution and value in driving your business forward.

However, not all real estate compensation models are based on a single, defined split.

For example, some agents keep 100% of the commission earned on a gross sales price and pay the brokerage a set ongoing flat fee, similar to paying rent. This would cover the real estate agent’s share of the brokerage costs. We’ll discuss this type of commission structure later.

8 Common Sales Commission Structures to Consider

As mentioned above, having a clear commission structure in place for your brokerage is essential. Here are eight different commission structures you can use within your business:

1️⃣ Tiered commission structure

A tiered commission structure rewards agents with increasing commission rates as their sales performance improves.

The commission rate increases once the agent hits certain earning milestones (or tiers) within a set period, such as a quarter or a year.

For example, the first tier might offer a base commission of 40% up to $50,000 in gross commission income (GCI). After that, the rate could increase to 60% for any GCI between $50,001 and $100,000, and then 80% for earnings above $100,000.

Because the commission is calculated on the total amount sold within a timeframe, this structure incentivises agents to close more deals as they’ll earn more commission.

However, calculating tiered commission can be complex to manage, especially if rates vary depending on multiple thresholds or reset every year.

2️⃣ A flat-fee model

Under a flat-fee structure, agents keep the same amount of commission from every sale, regardless of volume, and simply pay a fixed monthly fee to their brokerage.

That fee helps cover operational support, office space, or tech platforms and systems.

This approach offers agents maximum earning potential, especially high performers, since their brokerage cost doesn’t vary depending on how much they sell.

However, it can reduce your brokerage’s income per transaction, so it’s often best suited for brokerages with large teams or lower overhead costs.

3️⃣ Team split commission

A team split model distributes the total commission among all team members who contributed to a deal, such as a listing agent, buyer’s agent, transaction coordinator, or showing assistant.

Instead of a salesperson earning the full sales amount, each team member receives a portion based on their role in the transaction.

For example, a lead agent might receive 50%, the buyer’s agent 30%, and the remaining 20% is split between support staff.

While agents may take home less individually, this structure supports collaboration and can lead to higher overall team productivity.

4️⃣ Gross profit commission

Unlike traditional models based on a certain amount or sale price, gross profit margin commission is calculated based on the profit left after expenses such as marketing, materials, or team support are deducted.

This structure ensures agents are aligned with your brokerage’s bottom line, not just top-line sales. It’s particularly useful for teams that provide extensive support or invest heavily in leads.

Keep in mind that clearly defining “profit” in your agreements is essential to avoid disputes.

5️⃣ Graduated commission structure

In a graduated structure, the commission rate increases on portions of revenue once certain targets are reached. This is similar to tiered commission, but it’s calculated on each sale instead of cumulative earnings.

For example, it could be 3% on the first $250,000 of a property’s price, 4% on the next $250,000, and 5% on anything over $500,000.

This model rewards agents for closing higher-value deals and is often used in luxury markets. It can be more complex to calculate, but it offers substantial financial incentives on premium properties.

6️⃣ Straight commission

With a straight commission structure, agents earn a consistent percentage of each sale with no base salary. The agent’s income is directly tied to performance, which can be highly motivating for experienced or high-producing agents.

For instance, an agent might earn a standard commission of 3% of the total amount of the sale.

This simple, transparent model makes it easy to calculate earnings, but it may not offer enough financial stability for new or part-time agents.

7️⃣ Salary plus commission

Some brokerages offer a base salary along with a commission bonus. This hybrid model provides financial stability, making it appealing to new agents or those transitioning to salaried roles.

For example, an agent may earn a salary of $2,500 per month, plus 1% commission on each sale.

While earning potential is capped with an upper limit, this structure helps you attract talent and reduce churn among agents.

8️⃣ Draw against commission

In this structure, agents receive a regular advance payment (draw) that is later subtracted from their earned commissions. It’s similar to a loan from future income and can help smooth out irregular cash flow.

Once the agent closes the deal, the commission earned is used to pay back the draw. Anything above the draw amount is paid out to the agent.

It’s important to structure these agreements carefully so your agents don’t end up owing your brokerage during slower periods.

Here’s how you can determine which commission structure is best for your brokerage:

Mistakes to Avoid When Calculating Real Estate Commission

Now that you know how to calculate real estate commission, let’s look at some mistakes to avoid when doing so:

❌ Using cumbersome spreadsheets

Spreadsheets are a helpful tool if you’re running a small brokerage with a limited number of agents. However, your spreadsheet and other systems can quickly become overly complex and cumbersome as your team grows.

Relying on spreadsheets to handle extensive commission-related data can complicate the process of locating and reviewing individual records, increasing the likelihood of errors.

Commission management software like Paperless Pipeline’s Commission Module can replace spreadsheets and calculate commissions automatically with just a few clicks.

With our software, your chosen commission structure doesn’t matter; the tool can calculate accurate amounts in seconds.

❌ Errors from manual calculations

Trying to calculate commissions manually and then entering them into a spreadsheet may result in significant inaccuracies.

Having inconsistent or complex commission structures can also lead to incorrect calculations quickly.

Your commission structure should be clear, and all parties involved should agree to the structure you’ve chosen.

❌ Lack of automation

As mentioned above, calculating commissions manually can be time-consuming and complex, and it can also lead to errors. To avoid this, you need to simplify your commission calculations through automation.

Automating this aspect of your business means you don’t have to spend time calculating commissions, and there is much less room for error.

Try Out Our Free Real Estate Commission Calculator

To retain and motivate agents in the competitive real estate market, you must ensure they receive the correct commissions for every deal.

You can use our free real estate commission calculator to help you determine what you should pay your agents. This is a split, flat-fee, and tiered commission calculator to help you pay your agents accurate commissions.

Use Tools to Automate Calculations, Forecast Commissions, and Track Production

As mentioned above, manually calculating commissions can be disastrous if you make an error. It could be as bad as agents leaving your brokerage entirely. Luckily, there are tools to simplify this process, giving you peace of mind that you have handled everything correctly.

For example, an end-to-end transaction management system can track each agent’s split and automatically apply the correct percentage to their transactions.

Paperless Pipeline enables real estate brokers, admins, and transaction coordinators to accurately calculate commission splits and any other agent fees at the click of a button.

You’ll be able to access breakdowns like these with our real estate Commission Module:

The software also allows you to generate income reports and forecasts easily. This helps everyone on your team track their progress toward income goals, which is a crucial way to keep agents motivated.

Ready to Simplify Your Commissions Calculations?

Getting your commission calculations wrong could damage your brokerage. Relying on spreadsheets or manual calculations is the quickest way to make mistakes and pay your team incorrectly.

Paperless Pipeline is a purpose-built transaction management tool designed to help brokerages manage their transactions more effectively while remaining compliant and audit-ready.

Visit our website to try Paperless Pipeline for free for 14 days. You’ll discover how our software can help automate and streamline the real estate commission process.